In addition to SEBI’s attempts to safeguard investor’s capital against risk & continued volatility due to global pandemic, new framework with regard to FnO margin requirements are going to implement with effect from 1 st June 2020. The regulatory board has tried its best to motivate the traders to make protective or hedged positions by extensively lowering the margin requirements for hedging while the naked positions will require raised margins. Wisdom Capital has always been to the fore in offering highest leverage across the brokerage industry and already operating on the same line of idea. For margins; please click fo-margin-requirements

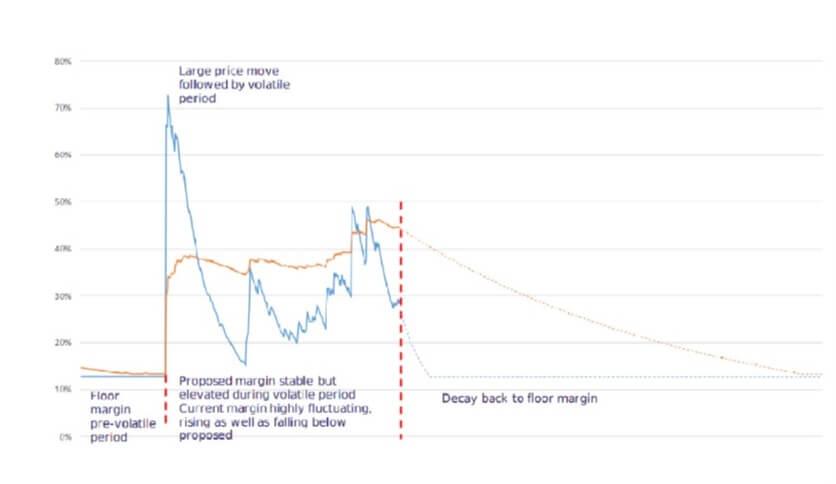

The group of traders who shape their positions by mutually engaging various financial instruments like future & options are going to be aided in a big way. The probable returns for such low-risk technics will upsurge. For instance, the requirements for vertical spreads like Iron Condor to be discounted by howling 70%. The Price scan range which is used to determine F&O margins is now changed to 6 sigma from 3.5 sigma. This implies that when markets are volatile, the margin required for naked positions will be higher than before. With prolonged volatility,the margin required for naked positions is up by ~20%. The higher PSR means that there won’t be a sudden spike in increase or decrease of margin going forward, it will be gradual.

| Aspects | Change | Implication |

|---|---|---|

| EWMA Volatility | Λ parameter changed 0.995 |

|

| Volatility | Margins based on 6σ/3.5σ |

|

| Extreme Loss Margin | Approximately halved | Reduce the notional component of margin |

| Short Option Minimum Charge | Discontinued | Reduce the notional component of margin |

| Margins for obligations | Net buy premium, settlement, replaced with COBG |

|

Achieving Stable and Conservative Margin: Simulation

| Hedging combination | Current Margin | New Margin |

|---|---|---|

|

|

|

|

|

|

|

|

|